showCASE No. 117 I Public Finances in the EU in the Wake of Covid-19 Pandemic

Editorial

The ever-rising government expenditures paired with decreasing tax revenues pushed governments to borrow at unprecedented levels to finance national Covid-19 pandemic responses, causing a huge spike in global public debt. The historically high levels of public debt stock in the EU thus pose risks for the sustainability of the public debt in the future, effective post-pandemic recovery, and long-term growth prospects.

Against this background, in this edition of showCASE, we discuss the effects of the pandemic on the EU government finances as well as relevant policy priorities to ensure healthier public finances in the future.

-----------------------------------------------------------------

CASE Analysis

Written by Mehmet Burak Turgut

The Covid-19 pandemic, which broke out in March 2020 and continued through subsequent waves in fall 2020 and spring 2021, resulted in a fallout in the global economic activity and world output contraction by 3.3% during the last year as shown by the recent IMF survey.

The losses in the output led to lower income and revenues of the taxpayers, which in turn diminished the tax revenue generating capacity of the governments. At the same time, the governments responded to the crisis with extensive fiscal support measures, amounting to more than USD 13 billion globally. These increasing expenditures paired with decreasing tax revenues pushed the governments to borrow at unprecedented levels, causing a huge spike in global public debt.

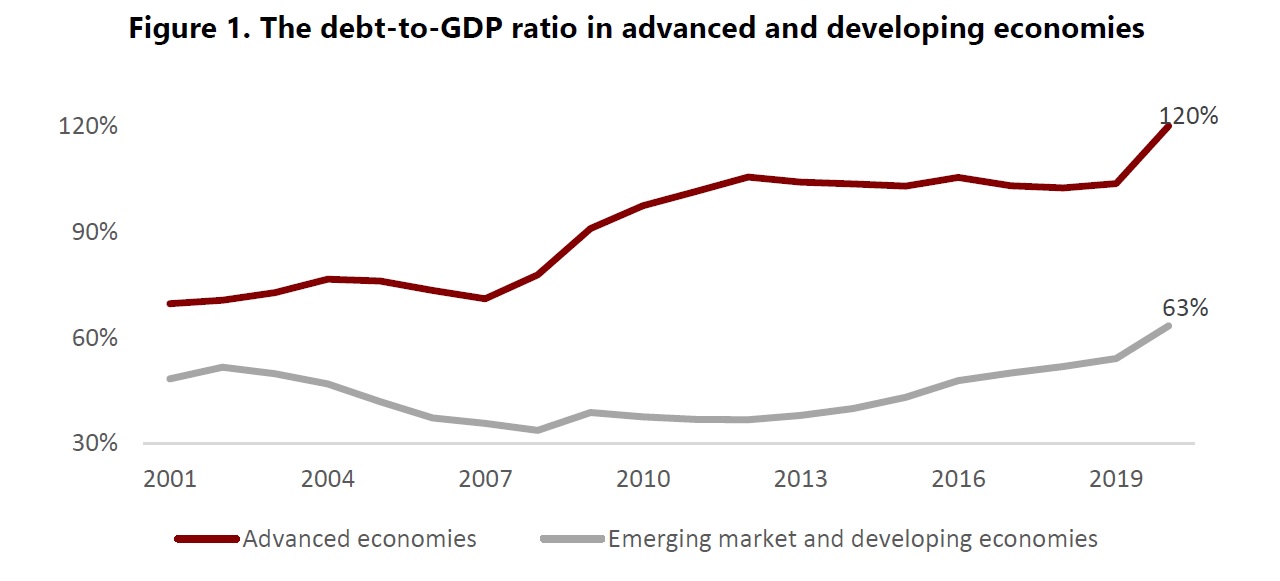

Figure 1 depicts the evolution of debt-to-GDP ratio over the last two decades for advanced (in blue) and emerging market and developing (in red) economies. The impact of the pandemic is visible for both groups – the debt-to-GDP ratio increased by 16.3 pp y/y for advanced economies and by 9.3 pp y/y for emerging market and developing economies, reaching, respectively, 120.1% and 63.4% in 2020. During the same period, government expenditures increased, respectively, from 38.6% to 47.4% and from 31.0 % to 34.0 % of GDP with the government revenues halting at 35.0 % and 26.0% for advanced and developing economies. The higher borrowing needed to finance the increasing expenditures during the pandemic time thus fueled the debt and elevated global government indebtedness to unprecedented levels.

Source: International Monetary Fund Fiscal Policy Responses to COVID-19, January 2021

The European Union Perspective

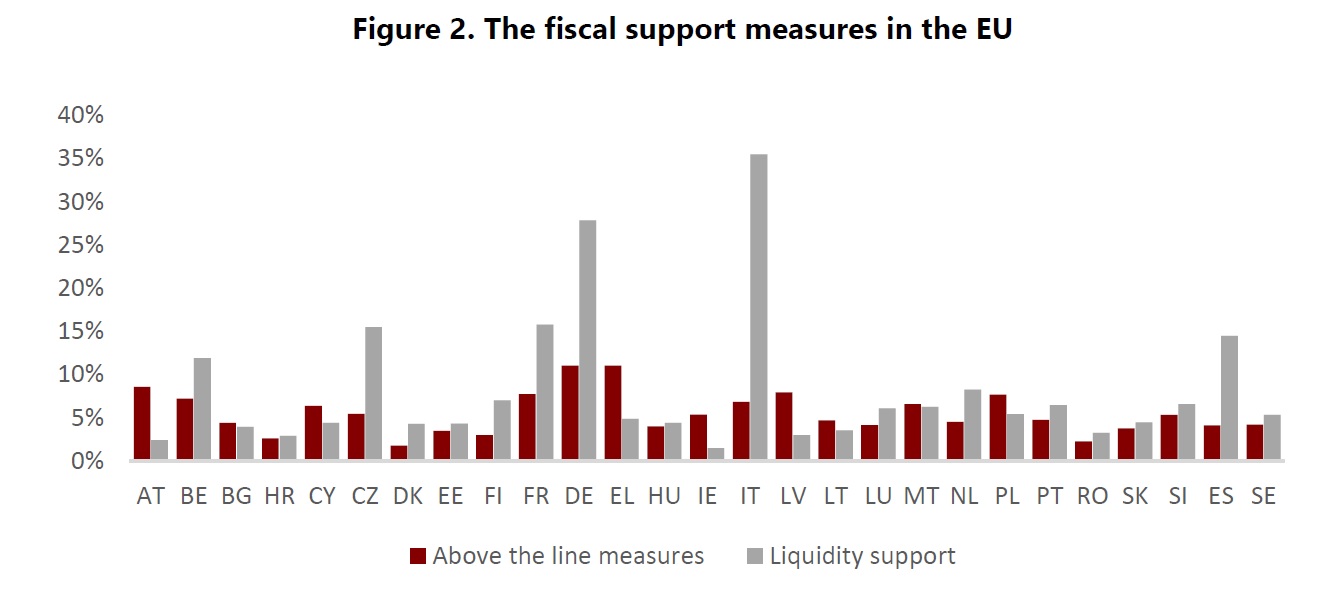

The governments in the European Union swiftly responded to the Covid-19 pandemic with substantial fiscal measures. As of January 2021, the sum of the EU-wide announced support amounted to more than EUR 4.4 billion, including EUR 1.4 billion above-the-line measures such as additional spending or foregone revenues as well as liquidity measures mostly in the form of loan guarantees and asset purchases.

Figure 2 shows the distribution of these fiscal support measures throughout the EU Member States (MS) as a percentage of GDP. The liquidity measures largely surpassed above-the-line measures in the four largest EU economies – Germany, France, Italy, and Spain – as well as Belgium and Czech Republic. On the contrary, additional spending or foregone revenues highly exceeded liquidity measures in Austria, Greece, and Latvia. The allocation of fiscal support between the above-the-line and liquidity measures was balanced throughout the rest of the EU Member States.

Source: Author’s own elaboration based on data available at Eurostat.

The scale of the national measures varied among the MS – from 5.5% in Croatia to 42.3% in Italy. Besides the individual country actions, the EU also introduced support measures from the Union’s budget that made up approximately 10% of total EU GDP for year 2020. How have these fiscal support policies affected and will affect the finances of the governments in the EU? The majority of the liquidity support measures is in the form of guarantees and the impact of these contingent liabilities on public debt depends on the extent to which the guarantees will be activated. Moreover, some parts of the above-the-line measures will be unfolded throughout 2021 and 2022 and may require additional amendments subject to the progress of economic recovery which means that their real impact on public debt is not yet certain.

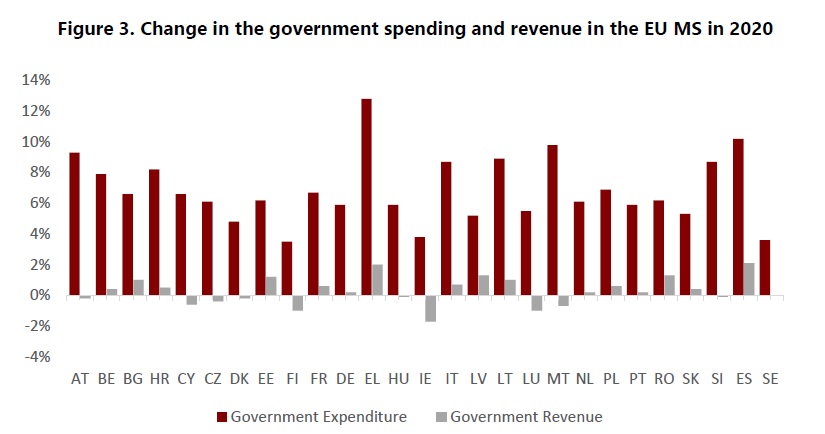

Figure 3 shows the changes in the government expenditures and revenues of the EU Member States measured as their share of GDP between 2019 and 2020. The government expenditure-to-GDP ratio increased in all MS in 2020 with y/y changes ranging between 3.5% (Finland) and 12.8% (Greece) throughout the EU. The automatic stabilizers and discretionary fiscal measures used to stabilize the economy in the wake of the pandemic are the main reasons behind the higher government expenditure-to-GDP ratio in the EU.

Source: Author’s own elaboration based on data available at Eurostat.

On the other hand, government revenue-to-GDP ratio did not experience substantial change in 2020 with y/y variations ranging between -1.7% (Ireland) and 2.0% (Greece). The main reason behind the relatively stable government revenue-to-GDP ratio during the pandemic was a proportional decrease in the levels of both components that resulted, respectively, from lower tax collection (fueled by the marginal drop in consumption and introduction of tax relief measures) and a comparable fall-out in economic activity.

Figures 2 and 3 also showcase that not all of the announced fiscal support measures in the EU became government expenditure because only part of the liquidity support measures were realised in 2020.

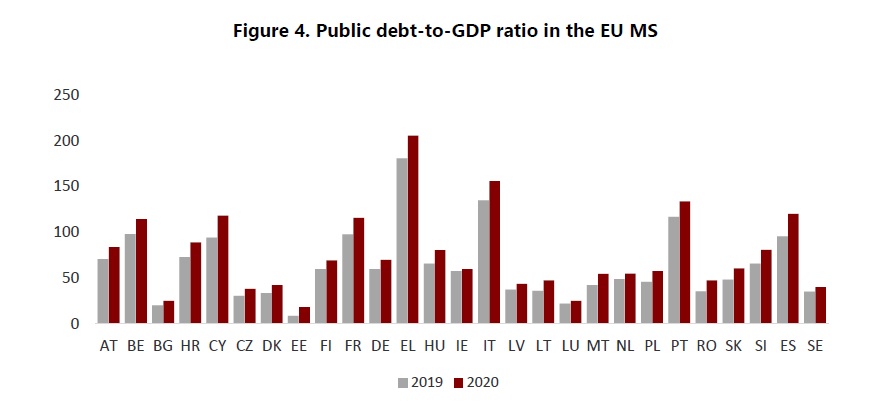

As a result of the spike in expenditures paired with the slack in revenues, the EU governments needed to borrow funds to finance these expenditures which has driven up the public debt. Figure 4 compares the public debt-to-GDP ratios of the EU Member States in 2019 and 2020. The y/y change of the ratio varies between 2.1% (Ireland) and 25.1% (Greece) with the 13.2% y/y change for the EU-27 which raised average levels of public debt in the EU to 90.7% of GDP in 2020.

Source: Author’s own elaboration based on data available at Eurostat.

Even though spikes were observed between March and May 2020, the surge in indebtedness of the EU Member States did not bring an increase in the sovereign debt risk premia which remained low in the major EU economies. This is partly due to (i) low interest environment which kept the debt costs manageable and (ii) decisive actions of the EU and Member States that repressed further collapse in economic activity. The rise of the public debt from the beginning of the pandemic has thus not exposed the EU economies to a higher sovereign debt risk so far.

Poland in Spotlight

The Polish Parliament introduced fiscal legislation packages titled ‘Anti-Crisis Shields’ in March 2020 that, as of January 2021, have already amounted to PLN 312 billion support in the form of additional spending, deferred revenues, loans and guarantees. This drove the government expenditures from 41.7% of GDP to 48.7% of GDP between 2019 and 2020 whereas the government revenue remained at 41.7 % of GDP. These changes in the two main blocks of fiscal policy moved the deficit from -0.7% to -7.0% of GDP between 2019 and 2020. As a result, the debt-to-GDP ratio in Poland jumped by 11.9 pp y/y reaching 57.5% in 2020. Despite such notable change in the debt-to-GDP ratio in 2020, it was still below the average EU change of 13.2 pp y/y.

The Future

The current debt stock of governments is historically high and is approaching the post-World War II levels. Even such high level of debt, however, can be sustainable as long as the global trend on the sufficiently low interest rates continues. Hence, what poses risks for the affordability of the public debt is a potential fast rise of the interest rates. Such a scenario would lead to large tax hikes and spending cuts that could curb the growth over the long term. Other than that, there are still some risks present due to the elevated public debt, including:

- limited ability to implement counter-cyclical fiscal policy during economic crisis;

- decreased ability to respond to unexpected events, like wars, financial crises, and natural disasters which could result in larger negative effects on the economy and on people's well-being;

- private sector under-investment due to uncertainty about future taxes and crowding out of private debt.

Despite the presence of the aforementioned risks, the start of mass vaccination campaigns in all Member States in 2021 has accelerated the return to a ‘new normal’ with the expected increase in economic activity. While this will help to improve public finances, the recovered economy should, nonetheless, be supported with policy efforts for healthier public finances. These efforts can focus more on building resilient and inclusive economic structure to curb the rising inequality, boost productive capacity, and raise potential output. For example, the Recovery and Resilience Facility of the Next Generation EU plan allows countries to finance such policy efforts with non-repayable support which will make it possible to finance growth-enhancing public investment projects and cover costs of productivity-enhancing reforms without inducing higher levels of deficit and debt. Besides, monetary policy can also play a role in strengthening these efforts. The ability of the central banks to maintain low interest rates despite rising inflation will allow to maintain price stability to serve the debt and prevent its further accumulation.