showCASE No. 102 I Belarusan Reforms: A Path Less Trodden

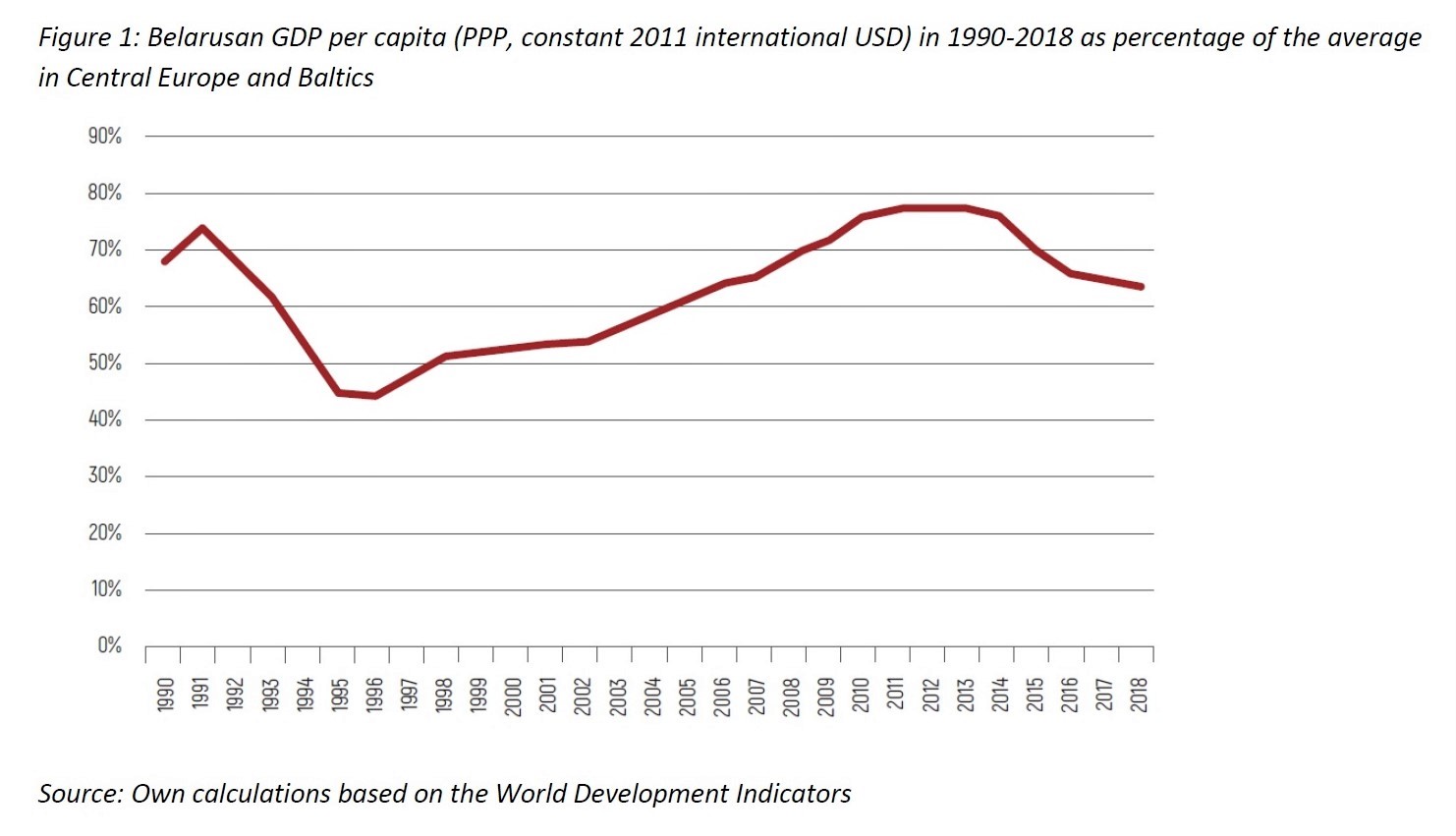

With fresh memories of a recession and its GDP per capita (PPP) lingering at 64% of the reference group, Belarusan economy shows plenty of room for reforms. If these are stepped up, the experience of CEE countries such as Poland may provide useful lessons.

The economic history of independent Belarus is a story of twists and turns. After sinking into economic turmoil, like many ex‑Eastern‑Bloc economies in the first half of the 1990s, the country managed to rebound and entered a path of dynamic growth for sixteen years between 1996 and 2011, nearly doubling the size of its economy – with not even the 2008 financial crisis forcing it into recession. Between 2012 and 2014, however, the growth decelerated to the range of 1‑1.7%, and Belarus actually experienced recession in the years 2015‑2016 (of ‑3.8% and ‑2.5%, respectively) before returning to moderate growth (1.5‑3%) sustained ever since. With Belarusan GDP per capita (PPP) lingering at 64% of that in Central Europe and Baltics (Figure 1), it seems that the growth model based on rationalising the command economy and striking opportune deals with geopolitical wooers from the West and the East has burnt out its fuel. New, organic engines are needed to kick‑start the Eastern European economy before macroeconomic imbalances begin to threaten the carefully nurtured social order.

The growth engines Belarus needs can be unlocked by a policy mix comprised of microeconomic liberalisation, macroeconomic stabilisation, and institutional transformation, a package that had once helped transform Central Europe from a post‑Communist backwater into an EU growth champion. First, the continued reliance in today’s Belarus on state‑owned enterprises (SOEs) as primary business vehicles undermines long‑term development, calling for microeconomic liberalisation. Because the Belarusan SOEs consistently underperform as compared to private enterprises, the continued public support they receive is effectively a misallocation of resources and a distortion of competition. It strains public finance (to the extent of coming directly from state budget) and penalises performance (to the extent of coming as cross‑subsidies from more to less profitable entities), and it should be phased out. Likewise, to enable a level‑playing field in the economy, SOEs should be made able to undergo bankruptcy – rather than enjoy the guarantee of sustained operation irrespective of performance – and eventually, solid anti‑monopolistic legislation should be adopted (see also below).

Second, while savings on SOE subsidies will work toward easing the fiscal pressures, further efforts will be needed to enhance macroeconomic stabilisation, including phasing out energy subsidies to households and keeping the wage growth within the confines of the productivity growth. Today, the balance between the two is undermined by the centrally planned wage targets, which may fuel inflation and should be eliminated. In Poland, which faced a similar challenge, a temporary tax dubbed popiwek was used in the early 1990s as a wage control mechanism, applied initially to all enterprises and later exclusively to SOEs. Another pressing issue related to macroeconomic stabilisation is foreign borrowing. By unlocking additional opportunities for consumption and allowing for technology imports, this mode of financing may seem advantageous in the short term but is very risky in the long term. In Poland, the consumption and investment spree of the 1970s, financed by foreign debt, led to severe macroeconomic imbalances a decade later, becoming a contributing factor to the fall of the Communist government in 1989. The noxious effects of foreign borrowing are also beginning to weigh on the Belarusan economy. With the external debt at 28% of the country’s GDP and access to low‑interest IMF loans obstructed due to stalled reforms, any future borrowing abroad should be carefully considered.

Third, for Belarus to steer clear of the oligarchic pitfalls suffered by its neighbours to the east and south – which reformed their institutions less than they liberalised their economies – genuine commitment to institutional transformation will be needed. Ultimately, the institutional transformation must encompass mechanisms that may seem prima facie unrelated to the market but that in fact have a fundamental effect on economic exchange. Crucial among them is the rule of law, which through the channels of property rights, legal certainty, checks and balances, and an independent judiciary promotes market exchange by increasing inclusiveness of transactions and decreasing their costs. A similar, transaction‑enabling logic should guide the development of anticorruption mechanisms. In all, it is essential that such mechanisms work in social practice rather than merely as legal acts, posing a challenge for civil society to not only demand and monitor, but also inspire and promote policies.

Of course, institutions of immediate economic relevance, such as anti‑monopolistic legislation, an independent Central Bank, and a macro‑prudential framework are also indispensable to a sustainable economy and should be strengthened where deficient. Fiscal rules, for example, exist in Belarus but show incoherencies across the central and the local levels of government and should be harmonised. Moreover, a debt anchor of a comprehensive scope, set at a sufficiently prudent but at the same time realistic level, should be introduced. In Poland, for example, a 60% debt to GDP ratio is entrenched in the Constitution, prohibiting the general and local governments to take loans or provide guarantees above that value in total, and the Public Finances Act lays down prudence thresholds of 55% and 60%, which, if breached, trigger countervailing measures such as a ban to increase wages or to index pensions and an obligation to prepare a corrective plan.

It is important to note that the reform avenues described above – microeconomic liberalisation, macroeconomic stabilisation, and institutional transformation – form a mutually‑complementary set of reforms that cannot be picked à la carte. For one, as the economic theory suggests and the CEE countries’ experience confirms, macroeconomic stabilisation is intimately linked with microeconomic liberalisation. Without the efficiency maximising effect of the latter, the Belarusan economy will continue to consume more than it is able to produce, undermining the budget or risking social discontent in case of sudden cuts. Likewise, without an equality of opportunity in economic life, vindicated by a strong rule of law, no true liberalisation will be allowed to occur.

Another caveat is that very different timespans apply to the different components of the reform package. While all should be undertaken as soon as possible, institutional transformation is almost guaranteed to take up longer time horizons than microeconomic liberalisation and macroeconomic stabilisation, due to the underlying inertia of social and political arrangements. Such has also been the fate of reforms in the CEE countries. In Poland, for instance, the macro‑prudential framework has suffered a number of setbacks, such as in 2013, when an erstwhile 50% prudence threshold was suspended in the face of post‑financial‑crisis turbulences, or in 2015, when a freshly introduced stabilizing expenditure rule was disarmed by a change in the forecasted inflation parameter. More worryingly, Polish commitment to the rule of law, until recently deemed all but complete, has since 2015 been put into question, with an erosion of checks and balances, infringements on the judiciary, and diminishing transparency, among others.

Indeed, there is no denying that the path of reforms is rough, winding, and often unpredictable. Whatever the future has in stock for a reforming Belarus, however, that stock certainly holds more promise than a path well‑trodden but dead-ended.

Written by Krzysztof Głowacki, CASE Economist, with contributions from the CASE Belarus Team

The article is based on the outcomes of the project 30 Years of Economic Transformation in CEE: Key Five Lessons for Belarus conducted by CASE and CASE Belarus between October and December 2019. A paper with key findings is planned for publication shorty.

On March 19, CASE Belarus organises Belarusian Economic Forum (BEF) in Warsaw, with over 15 speakers from 5 countries, including Minister of Economics of Belarus Aleksandr Chervyakov (TBC) and CEO of the Warsaw Stock Exchange Marek Dietl. You can see the agenda and register here.