CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate

In 2017, VAT revenue in Poland went up by 14.9 % in relation to 2016. The increased VAT receipts are due to three factors: an 8 % increase in VAT compliance, a 0.4 % increase in the effective VAT rate, and a 6 % higher tax base (comprising in consumption and partially investment) – the latest CASE – Center for Social and Economic Research report, Study and Reports on the VAT Gap in the EU-28 Member States”, has revealed. The report was commissioned by the European Commission.

“Thanks to our methodology, not only we can estimate the VAT Gap, but also state the cause and the extent of the increase in VAT revenue in EU Member States. According to our calculations, the increase in VAT revenue in Poland from 2016 until 2018 was due, in almost equal measure, to both better VAT compliance and economic tailwinds,” said Dr. Grzegorz Poniatowski, Director of Fiscal Policy Studies, heading the team that produced the report.

Other CEE countries also saw an increase in VAT revenue in 2017, mainly due to economic growth; Hungary recorded a growth of 9.9 %, Czechia of 9.5 %, and Slovakia of 9.2 %. In the EU as a whole, VAT revenue went up by 4.1 % (more information can be found in the REPORT, table 1.3, page 14).

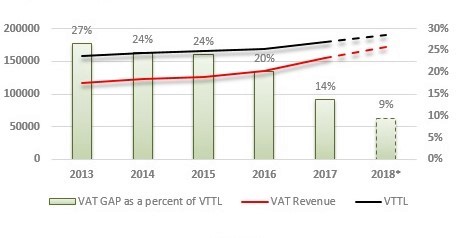

Figure 1. VAT gap as a percentage of liabilities, VAT revenue, VAT liabilities in 2013-2017 (millions PLN)

Even though in 2017 there was an improvement in VAT compliance (the VAT Gap decreased by 6.4 percentage points to 13.7 % ), the VAT Gap in Poland continued to exceed the EU average of 10 %). Our calculations show that foregone VAT in Poland in 2017 came to more than PLN 24.5 bn (EUR 5.8 bn). So called “fast estimates” published in the report reveal that in 2018 the VAT Gap in Poland fell below 10 %.

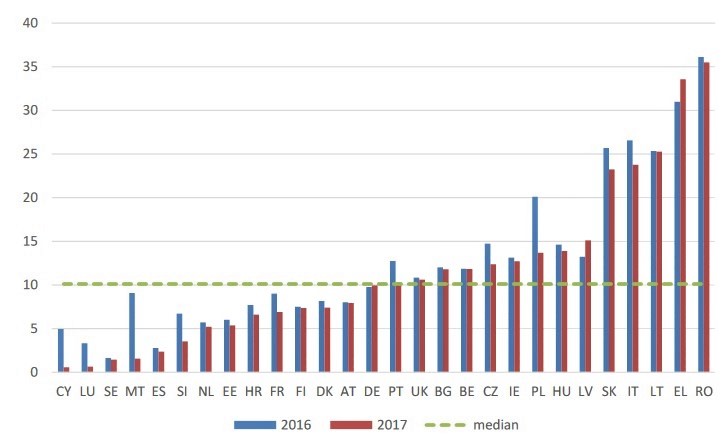

This is a trend that can be observed in almost every EU Member State. In 2017, the VAT Gap shrank in 25 countries, while it rose in three: Greece, Latvia, and slightly in Germany. In total, the losses in VAT revenue for the 28 EU countries amounted to EUR 137.4 bn (a reduction in the VAT Gap of EUR 8 bn on 2016). Percentagewise, this is a decrease in the Gap from 12.2 % in 2016 to 11.2 % in 2017. According to “fast estimates”, the EU VAT Gap for 2018 will likely be below EUR 130 bn.

The VAT Gap shows the shortfall between VAT liabilities and the true public budget receipts. The VAT Gap is due to a number of factors, including tax evasion, tax avoidance, and fraud that in the EU in recent years have taken the form of VAT carousels, in which VAT goes missing in transactions between companies, using missing trader, and a zero rate applied in intracommunity trade.

Figure 2. VAT gap in 2016 and 2017 as a percentage

The VAT gap is estimated using data from national accounts and detailed data from member states. The methodology used was developed and improved over a number of years, and currently the VAT Gap estimate combination is the best in terms of costs and accuracy. For the first time, this year’s report also includes so called “fast estimates” for VAT in 2018.

“Study and Reports on the VAT Gap in the EU-28 Member States” was commissioned by the European Commission (DG TAXUD) and written by a team of experts, directed by Grzegorz Poniatowski, and composed of Mikhail Bonch-Osmolovskiy, Adam Śmietanka, José María Durán Cabré (University of Barcelona) and Alejandro Esteller More (University of Barcelona).