showCASE No.97 I Fifteen Years in the Single Market

The article is based on a chapter by Prof. Jan J. Michałek from a special report prepared by CASE for the 15th anniversary of Polish membership in the European Union. The Polish version of the report is available here; the English version will be published soon.

The Single Market and Trade

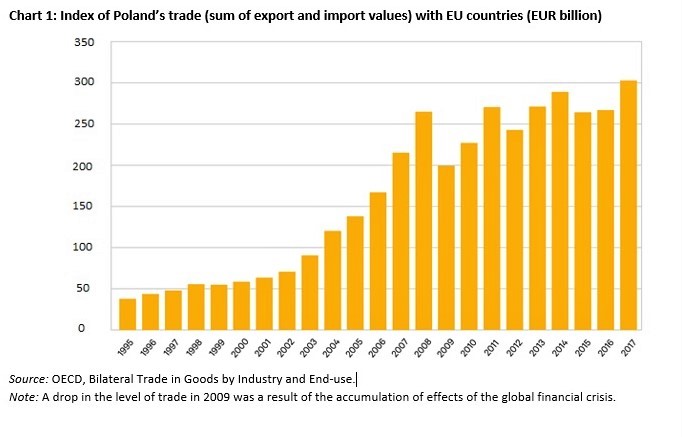

The liberalisation of trade pursued by the European Union (EU) under the European Single Market (ESM) facilitates the development of trade based on market principles where partners mutually profit from trade instead of one gaining and the other losing. For example, Germany, which has capital and the technical knowledge, can competitively manage the manufacture of modern cars, while Poland, which has a well‑educated and continuously cheap workforce, can efficiently perform more labour‑intensive tasks such as, for example, manufacturing and assembling components, thereby also becoming an important link in European automotive industry value chains. Such exchanges between Germany and Poland increase prosperity in both countries. By acceding to the EU in 2004, Poland became a member of the ESM. Poland’s international trade with member states demonstrated a great – and accelerating after 2004 – pace of change, having more than tripled. The scale of this phenomenon is shown on Chart 1.

Studies prove that, thanks to the existence of the ESM, the number of varieties of goods available to domestic consumers increased during 1999-2008. These changes were the strongest for new EU members from Central and Eastern Europe (including Poland), whose GDP rose by 1.7% thanks to increased imports of different varieties of products from member states. There are also studies that analyse the development of related economies of scale in Poland. For example, one study estimates that this phenomenon occurred in 2004-2010 in the manufacture of paper, coke and petroleum refining products, rubber and plastic products, metal products, computers, electronic and optical products, and cars.

Foreign Direct Investment and Global Value Chains

Owing to the free movement of capital within the Single Market, by the end of 2016, the majority of Foreign Direct Investment (FDI) – over 90% – in Poland came from EU countries. The highest shares were the Netherlands (EUR 33.9 billion), Germany (29.2 billion), Luxembourg (23.5 billion), and France (17.8 billion). FDI is concentrated in several sectors of the economy, such as finance and insurance, the services sector, and the processing industry – in particular, the automotive industry. In 2016, there were a total of 24,780 entities with foreign capital. They employed 1.85 million people, and nearly half of their capital was invested in the Masovian Voivodeship (47.4%).

Investments in the automotive industry have made Poland an important exporter of cars (Volkswagen, Opel, Fiat, Toyota, Man, Volvo, Isuzu) and car parts. Over 90% of automotive production in Poland is exported (mainly to Germany, Italy, and other EU countries) and constitutes the most important item in Polish industrial export (over 16%). Thanks to FDI, professional car repair services have developed, and suppliers of car parts have been working with foreign manufacturers, meeting their technological and qualitative requirements. FDI influences economic growth and society’s well‑being. According to the latest estimates, the inflow of FDI into Poland increased its economic growth rate, but the change was relatively small. It can be stated that much stronger growth effects took place in the sectors that attracted the most FDI.

In a globalised economy with strong FDI flows, the direct cooperation of companies within global value chains (GVC) is of great importance. A synthetic measure of the commitment of a given economy in a global added value chain is the GVC share index. This index is the sum of two components: demand, which is the foreign added value contained in the net export of a country (backward links), and supply, which is the share of domestic added value contained in the export of other countries (forward links). Out of the 64 countries for which indices were calculated in 2015, Poland was ranked high at 15. This means that Poland not only actively participates in international trade, but is also strongly tied to many manufacturers in Europe and the world.

Services

The liberalisation of the services market and the introduction of the single market in the EU progressed much slower than the goods liberalisation. The comprehensive, common liberalisation of commercial services took place only in 2006 as part of the Services Directive (2006/123/EC); however, its implementation has been proceeding gradually. One study estimated the potential benefits ex-ante of this Directive for Poland. According to their calculations, GDP should increase by 0.2-0.4% depending on the scope of its implementation. The largest growth of Polish exports can take place for construction services (up to 27%), business services (up to 27%), entertainment services (up to 15%), air services and road transport services.

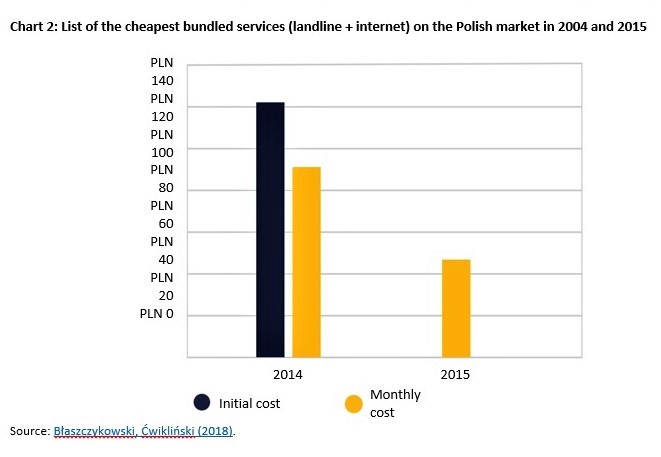

The liberalisation of market access was particularly important for several key sectors. For example, for electronic communication (telecommunications services), a series of directives were introduced in 2002, 2009, and 2011[1] with the objective of increasing competition in the EU market by harmonising rules, facilitating access to infrastructure, creating domestic regulatory bodies, supporting consumer freedom of choice and allowing consumers to benefit from innovative services. In effect, domestic markets have opened, and the prices of telecommunications services have dropped. Since 2007, the retail prices of cellular connections in the EU dropped by 92%. SMS prices began to drop in 2009 and have since also dropped by 92%.[2] Thanks to this, a very demonstrable drop in all fees took place, in particular, those for data downloads abroad and making phone calls. This means that business costs for companies have decreased considerably and that tourists can use telecommunications services with essentially no additional costs. This also facilitates the development of trade and service ties as well as tourism. The prices of telecommunications services in Poland have gradually decreased. For example, the prices of bundled services in Poland are shown in Chart 2. Another example of a sector which featured a very noticeable liberalisation is the air transport sector. Owing to it, between 2003 and 2011, the share of traditional (state‑owned) carriers in Poland dropped from 99% to approximately 52%.[3]

Wrapping up

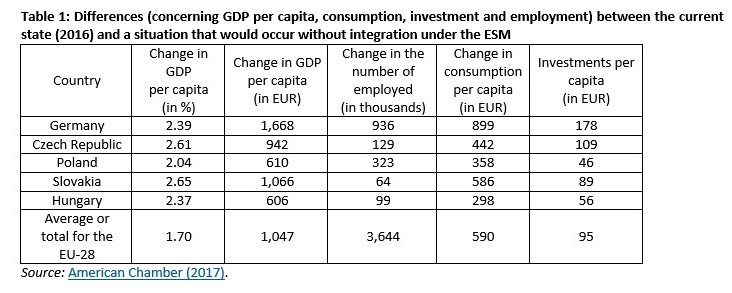

Broadly speaking, the overall effect of the single market for EU countries, including Poland, was a significant reduction in transaction costs. This led to the increased trade of goods and services and increased foreign investments, which increased the revenues of companies and the GDPs of member states accordingly. The ESM increased the EU’s attractiveness as a trade partner for third countries and resulted in the increased diversity of goods available to consumers. It also created at least several million new jobs. Liberalisation of the services sector has led to increased competition and a significant reduction in prices for consumers. This was particularly visible in the telecommunications and air transport sectors. In conclusion, we should mention the results of a study conducted by the American Chamber of Commerce (2017). Its findings are based on summarised indices of the level of integration of a given country with the EU, which include the level of openness and ties of a given economy (e.g. through FDI) to other EU countries. The summarised integration index for Poland (77.3) was close to the EU average (75.9). The lowest index was identified in Greece (54.3), while the highest (over 88) were identified in the Czech Republic, Ireland and Slovakia. The results of this analysis are presented in Table 1.

The analysis presented suggests that Polish GDP was higher by approximately 2% as a result of the ESM, compared to the counterfactual of no integration. In effect, consumption and investment per one resident of the country were also higher. Moreover, employment was also higher by 323 thousand people.

[1] The following directives were implemented: 2002/20/EC, 2002/19/EC, 2002/22/EC, 2002/58/EC, Regulation No. 1211/2009 and Regulation (EU) No. 531/2012.

[2] See http://biznes.onet.pl/wiadomosci/ue/roaming-w-ue-nowe-zasady-od-15-czerwca-2017/7kezem.

[3] The airlines that appeared in the Polish market include Ryanair, Wizz Air, EasyJet, Germanwings, Centralwings, SkyEurope, and others (see Cieślik and Michałek, 2015).

Photo: Forum