CASE CREDIT IMPULSE: The case for a rebound in global growth in Q1-Q2 2020 is getting stronger

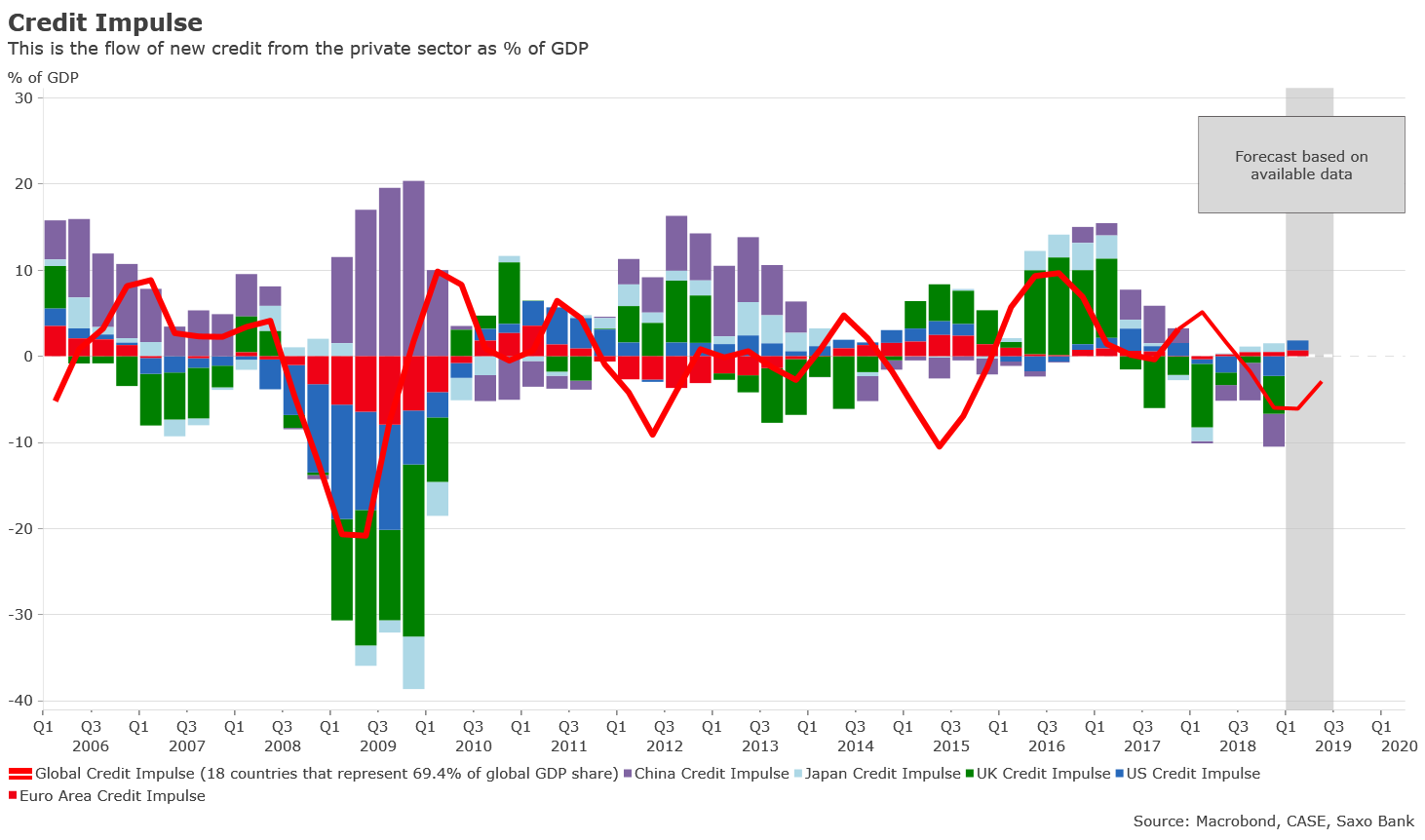

One of the main difficulties in economics is to identify turning points in the business cycle. The notion of Credit Impulse tries to solve this issue by focusing on the evolution of the flow of new credit calculated as percentage of GDP. CASE publishes a quarterly update on Credit Impulse for the main global economies and Poland.

Based on preliminary data, global credit impulse - the second derivative of global credit growth and a major driver of economic activity - is giving signs of life. It is still in contraction, at minus 3.8% of GDP, but slowly moving upwards. Currently, more than half of the countries in our sample, representing 69.4% of global GDP, have experienced an acceleration in credit impulse over the past quarter. The improvement in global credit impulse is mostly due to slightly better China credit impulse and strong credit push in the United States.

China is trying to reverse measures taken over previous years that reduced liquidity and credit flow, especially from small banks. China credit impulse, which is the main contributor to global credit impulse (1/3 of the total pulse), is still in contraction at minus 3.8% of GDP but moving upwards. We expect the trend will continue in coming quarters in order to offset headwinds due to weak demand and impact of trade war. We already start to see signs of stabilisation of the economy: the volume of rail freight - a key leading indicator - is well-oriented (9.1% YoY in July), new exports orders for large-sized companies are giving signs of life and total fixed asset investment growth has been broadly stable in recent months, as state investment offset lower private investment. The weak spot is mostly related to domestic demand, meaning further measures to stimulate it are about to be announced.

In addition, the new easing cycle starts to have a positive impact on developed market countries. The United States has opened the credit tap again with credit impulse standing at 1.2% of GDP, the highest level since early 2018. The positive trend is also visible in demand for C&I loans which has been solid over the past quarters, reaching a peak at 9.3% YoY in Q1 2019. Looking at credit data in the United States, we don’t see clear signals of imminent recession which is in contradiction with the message sent by the bond market. Considering the economy is at the end of the business cycle and faces trade war risk, most of contributors to GDP growth remain well-oriented, which tends to confirm our scenario of low growth.

Global credit impulse leads the real economy by 9 to 12 months. If our model is correct, we should see a rebound in global growth in Q1-Q2 2020 after reaching a low point in H2 2019. Countries that should benefit the most from improved credit pulse are those with strong trade links with China, especially South Korea, Japan and Australia. We also expect that the effect of credit pulse will be amplified by fiscal pulse in many countries. Upcoming debates over 2020 budget should path the way for demand-oriented stimulus and infrastructure investments.

Technical recession for some countries in sight

Currently, there are nine major economies in recession or on the verge of it: Argentina, Brazil, Germany, Italy, Mexico, Russia, Singapore, South Korea and the United Kingdom. Interestingly, out of the nine, five went through a sharp and often prolonged contraction in credit impulse. Along with China’s importing less, trade war friction and, in some cases, bad domestic policies, negative credit impulse appears as one of the key drivers behind poor economic performance in these countries.

This is particularly the case for the United Kingdom that has experienced seven consecutive quarters of contraction, with credit impulse running at minus 4.4% of GDP. The lack of new credit growth fueling the economy substantially increases the risk of recession in highly indebted countries, like the United Kingdom. Despite Q2 GDP contraction, we think the likelihood of a technical recession is remote in Q3 2019 due to the combination of stockpiling and positive consumer sentiment ahead of Brexit deadline. However, everything is already in place for recession. It is only a matter of time before it happens, more probably in early 2020 if no-deal Brexit prevails.

The case for recession in Q3 is stronger for Germany. Germany’s credit impulse has been decelerating since Q1 2018, only running at 0.4% of GDP according to the latest estimate. On the top of that, the manufacturing sector is in disarray and we start to see a contagion of weakness from manufacturing to services. The latest German PMI Services was out a solid 54.4 in August but lower from its highest annual point of 55.8. The gap observed between the manufacturing sector and the service sector is doomed to be reduced in coming months, with the service sector going down. Technical recession for Germany is our central scenario for Q2-Q3 2019.

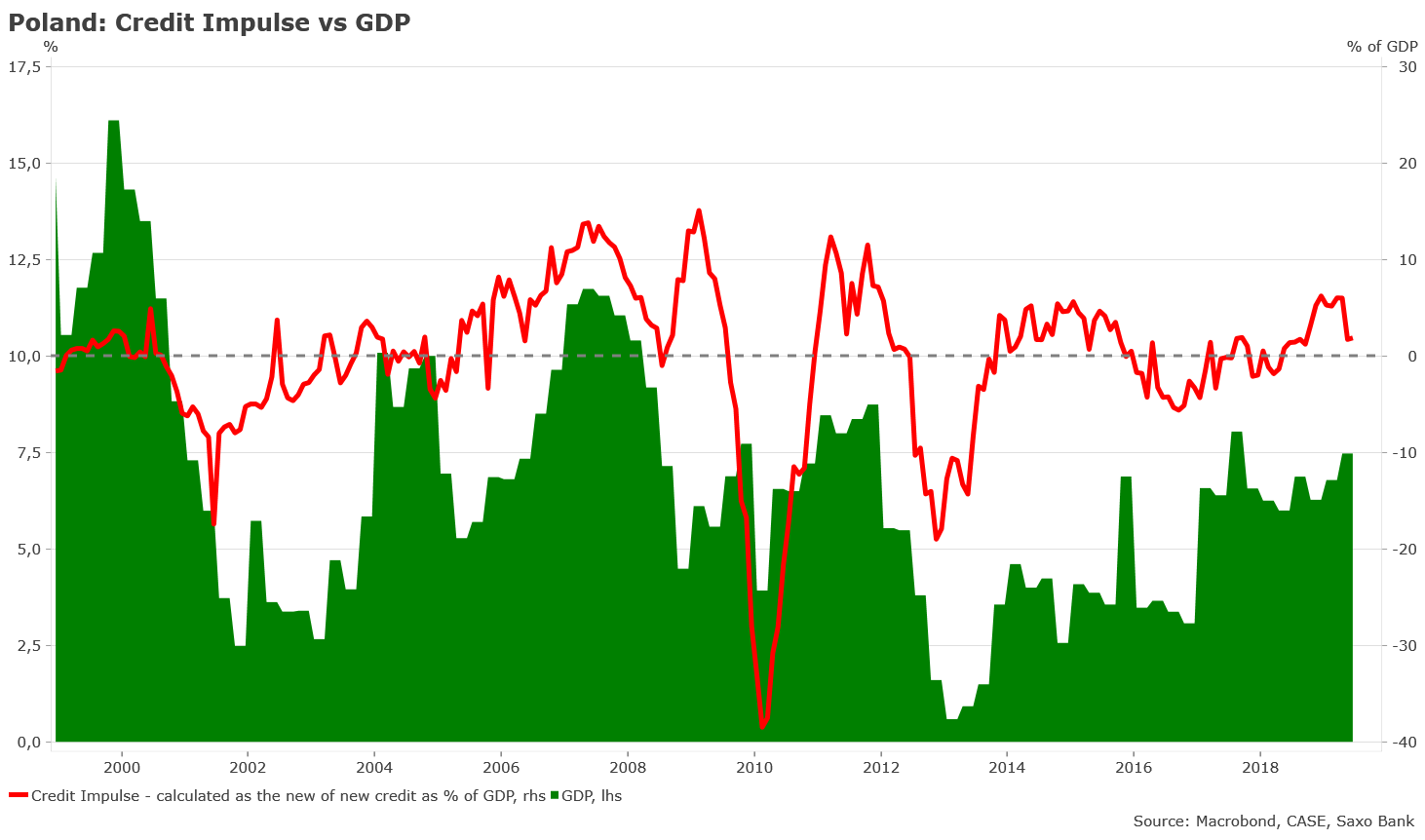

Poland remains resilient despite growing external headwinds

On a final note, Poland’s economy is still very resilient despite the negative impact of Germany’s slowdown. It is partially counterbalanced by low PLN exchange rate, which makes exports very profitable, and strong inflow of new credit in the economy. In Q2, Poland’s credit impulse was out at 0.6% of GPD, but the economy continues to be fueled by the strong push over the period Q4 2018 to Q1 2019 when credit impulse reached a peak at 2% of GDP, the highest quarterly level since beginning of 2012. Financial conditions are still very accommodative at the domestic level and we don’t see major risks to growth in the short and medium term, except for higher inflation (showCASE No. 96 I Inflation on the Rise).