showCASE No. 93 | Barriers to (Digital) Services Trade

By: Anna Malinowska, CASE Economist

Introduction – what is the significance of the Single Market for services?

The EU’s Single Market, with its current consumer base surpassing 500 million, has increased the productivity of European businesses via specialisation and scale effects. With the economic importance of services on the rise, their growing influence on the smooth functioning of manufacturing sectors, and their prominent role in the Digital Economy, in 2006 EU authorities implemented the Services Directive aiming to create a Single Market specifically dedicated to services. Yet, the initiative did not rise to the challenge: Copenhagen Economics reported that the Single Market cut as much as 20% of the trade costs in goods, but only 7% in case of services. Furthermore, intra-EU trade in goods accounted for 23% of the EU’s GDP (at EUR 3030 billion in 2016 [+169% since 1993]), while intra‑EU trade in services only for 8% of it (at EUR 1060 billion in 2016 [+244% since 1993]). The effects of this lack of integration have been felt via fragmentation of the Single Market for services, raising barriers to business. These developments, while reducing the ability to engage in trade activities and barring entrance to new markets for all businesses, have been most acutely felt in the sector of small and medium-sized enterprises (SMEs).

The growing importance of services has a number of sources, among which digitalisation, innovation, and ‘servitisation’ (increased reliance of the manufacturing sector on services) emerge as the most prominent. Digitalisation came across as a game-changer, introducing novel complementarities between goods, services, innovation, business models, and interactions between people and machines. In this context, the costs of adhering to the status quo of the intra-EU barriers to (digital) services trade have grown exponentially. Indeed, easier (cheaper) trade in services will not be limited to the services sector only, but it will have positive spill-over effects throughout all strata of the EU economy.

In recent years, there has been rapid growth in trade in digital services (i.e. the ICT services sector as a key element of the EU’s digital frontier), one which effectively overshadowed increases in ‘general’ services trade in the region. Yet, benefitting from this phenomenon hinges on how economies perform in the digital services area – something European countries have not been very good at, according to the McKinsey Global Institute’s Industry Digitisation Index.

The Digital Single Market and barriers to (digital) services trade

With digitisation gaining more importance, the EU developed an initiative aiming to enhance the region’s business environment. In particular, the Digital Single Market's (DSM) overriding objective, since its inception, has been the opening of digital opportunities to businesses and individuals across the EU. According to the European Commission, the completion of the DSM could produce significant economic impact across the EU as it is estimated that the process may add approximately EUR 415 billion annually to the region’s economy both via employment creation and enhancements in the

public services sector. Implemented in May 2015, the DSM strategy delivered 16 particular initiatives, which are currently discussed from the legislative perspective by the European Parliament and the Council. The strategy itself encompasses three major areas:

- Accessibility – providing individuals and businesses with better access to digital goods and services EU-wide;

- Environment – ensuring appropriate environment and levelling the playing field for digital networks and innovation-rich services;

- Economy and Society – fostering the growth potential of the digital economy and of benefits for the society.

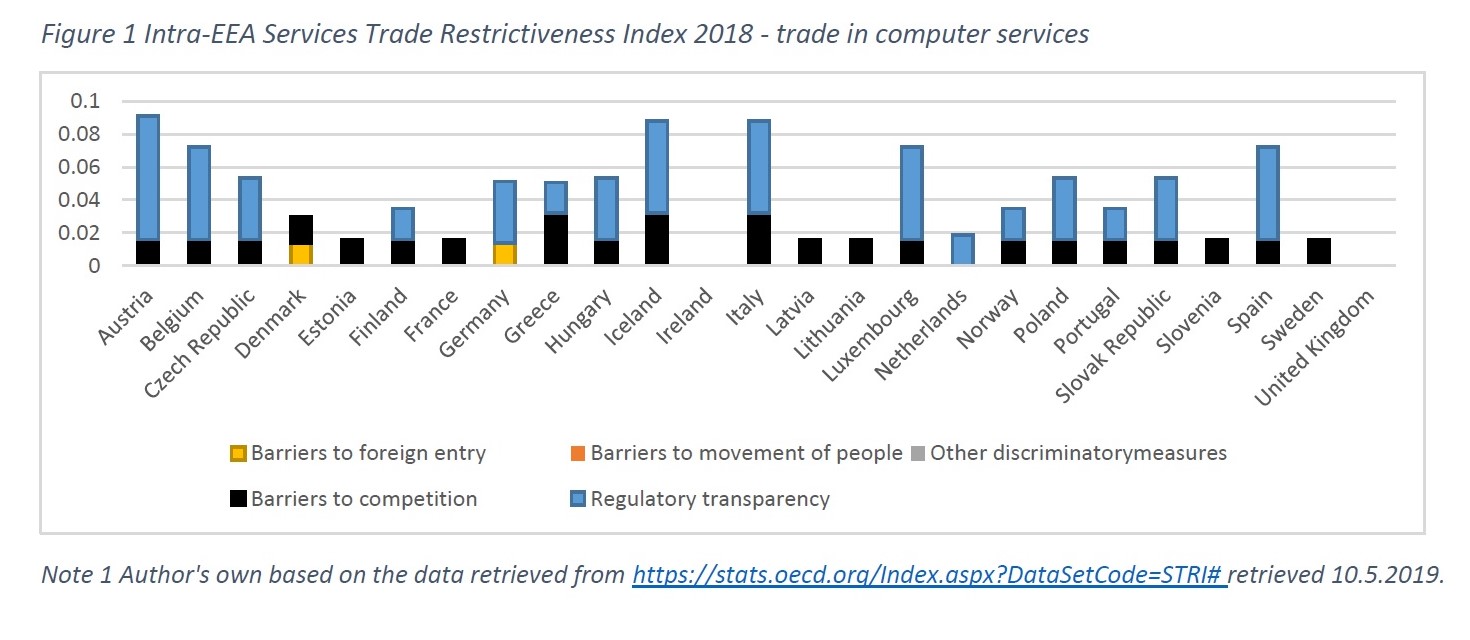

As shown in the latest CASE analysis commissioned by Poland’s Ministry of Foreign Affairs, trade within the European Economic Area (EEA) in the ICT services sector, appears as relatively barrier-free (Figure 1; the indicator takes values in the range 0-1, with 0 equivalent to ‘no barriers’). This state of events likely stems from the fact that the ICT services sector’s development preceded its regulation in the last three decades. One may in fact argue that the rapid development of the sector can be ascribed to the fact that it remained unregulated for so long.

As far as specific barriers are concerned, in the EU (or, more broadly speaking: the EEA), there emerge only two significant categories of obstacles: economy-wide restrictions related to regulatory transparency and administrative measures, such as waiting periods and costs associated with dealing with bureaucratic issues related to setting up companies or obtaining licences, on the one hand and barriers to competition such as unbundling and state-control, on the other. As for barriers to foreign entry, movement of people, and any other discriminatory measures, they are, by far and large, absent (indeed, the UK and Ireland appear to have none whatsoever!).

Based on the above, one may be inclined to think that the ICT services trade within the EU should be relatively smooth. According to the CASE report cited above, while it may be possible that the Digital Single Market and the ‘traditional’ Single Market fuel each other’s development, the fact that the latter could fall behind the digital economy, both in terms of regulatory solutions and economic gains, has been a real possibility. In particular, two issues related to the digital economy needed more attention:

- Scale effects (including network effects), which mean that the bigger the market, the greater the expected efficiency gains (especially in case of SMEs, which may find market for their products more easily).

- Heterogeneity of national regulatory frameworks, which contributes significantly to market fragmentation and generates additional fixed costs.

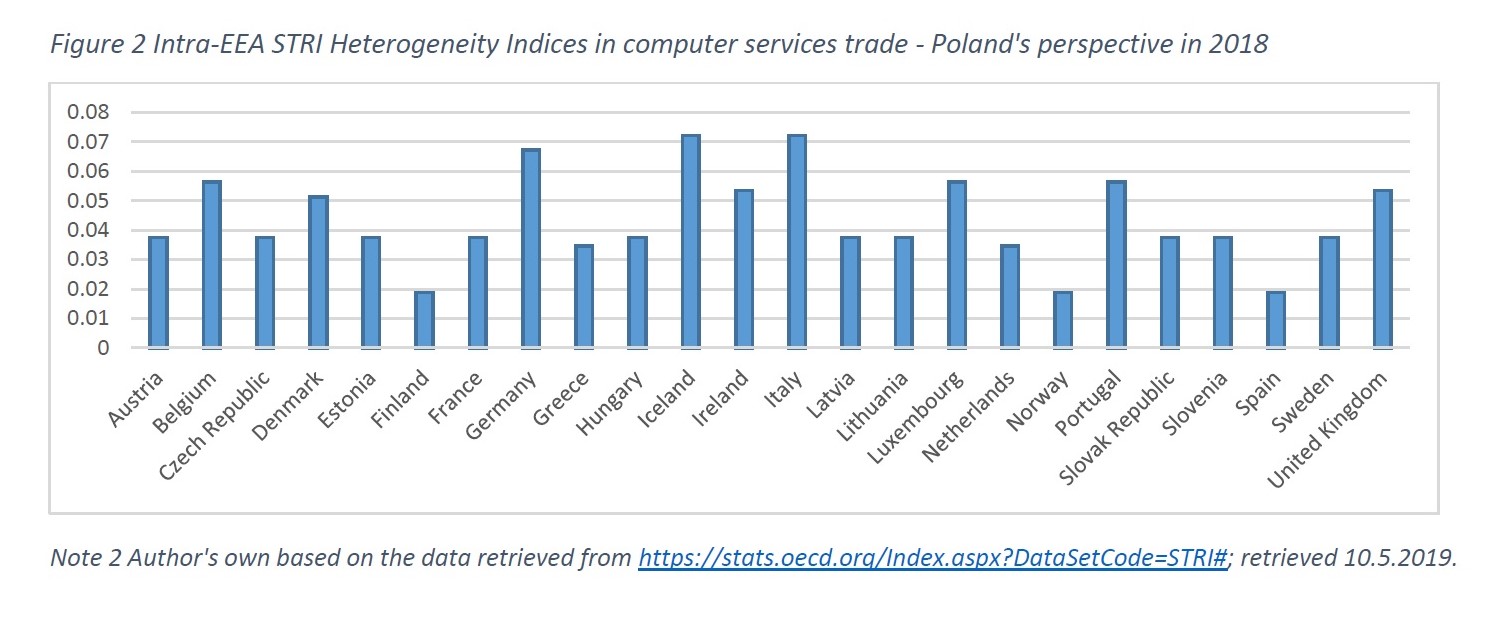

Despite the near non-existence of barriers to trade in the ICT sector, the heterogeneity of the ones that do exist may work to reduce intra-EEA trade. In this case, the metric assesses (for each country pair and each measure) whether the countries boast the same rules and regulations. For instance, the divergence between the Poland’s regulations and the relevant frameworks across the EEA is significant (Figure 2). This is not to say that Poland’s regulatory frameworks in the ICT services trade have been contradictory to most legal rules observed across the EEA – in fact this only exemplifies the scope of regulatory diversification at the national level, something that slows down the integration processes and generates compliance costs thus mitigating intra-EEA trade.

While the services trade barriers in the ICT sector may be described as negligible (cf. Figure 1), the relative newness of the DSM has spurred uncertainty regarding a number of issues, inter alia, future EU-wide regulatory standards, business and political risks, and fragmentation of the market. CASE experts pointed out several issues which may be particularly important (both legally and ethically) in the digital (and ICT) services trade across borders: cybersecurity (identification and authorisation procedures concerning both individuals and businesses required to manage contractual relationships and liabilities), geo-blocking, location-based profiling, intermediary liability, e-privacy to name a few. Given the plethora of unregulated issues, the development of relevant legislative solutions, while preventing the emergence of new barriers in digital services trade, may contribute to the establishment of new, yet unnamed, EU-wide obstacles in this field and beyond.

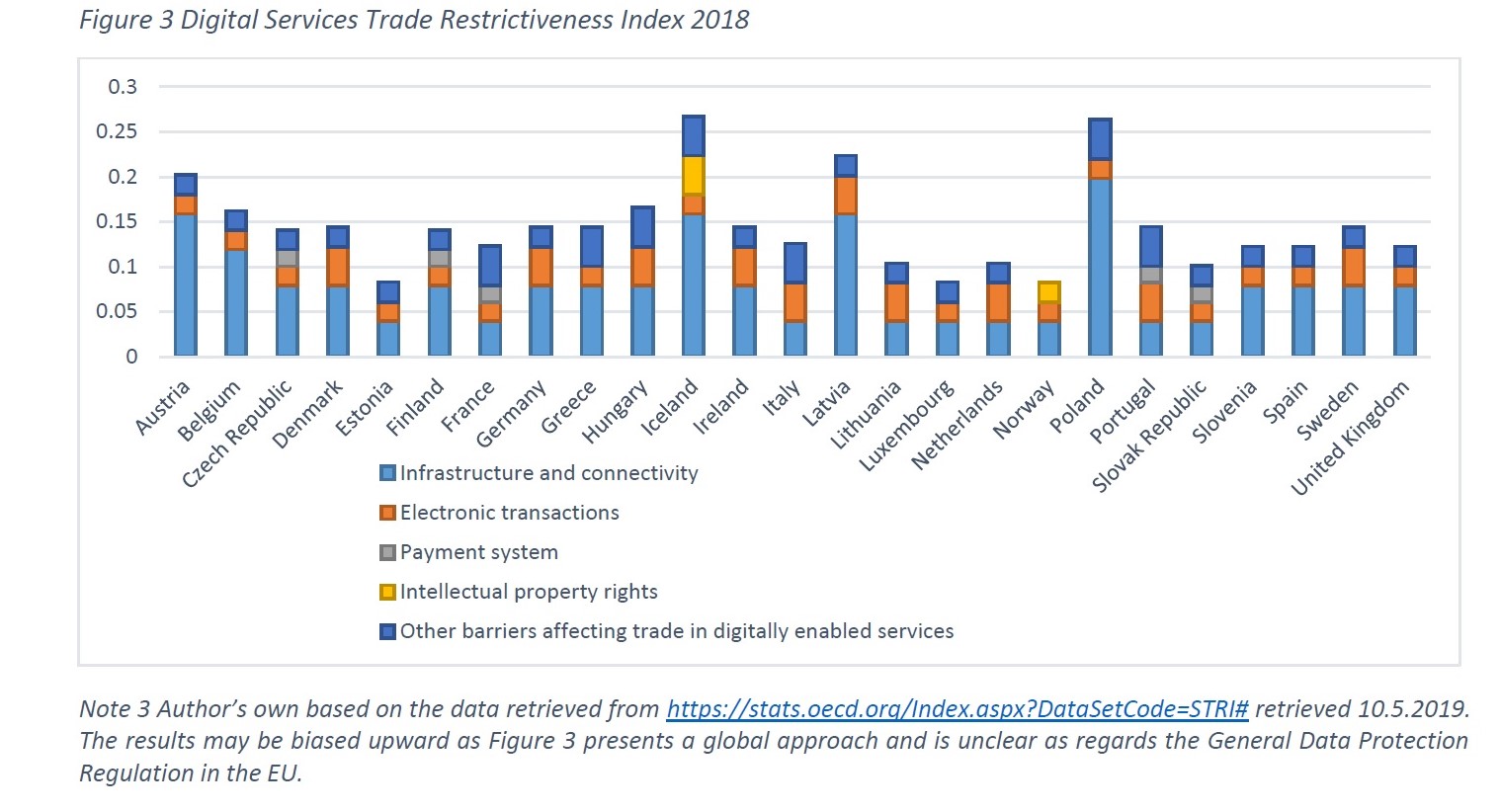

Globally, the barriers to digital services trade are sizeable (Figure 3), with the most problematic being restrictions in the area of connectivity and infrastructure (i.e. communication infrastructure required to engage in digital trade, including measures on cross-border data flows and data localisation), and barriers to electronic transactions (including but not limited to issues regarding measures of electronic authentication) and ‘other’ barriers both being second most important categories. The former’s role in digital services trade is prominent, as it provides smooth communication between trading parties; the latter captures hindrances to foreign companies as far as e-commerce licensing, online tax registration and declaration are concerned. Barriers to payment systems, i.e., access to payment methods and aligning domestic security standards with international ones are marginally important, as opposed to a collection of ‘other’ discriminatory measures (such as limits on advertising or streamlining to name but few).

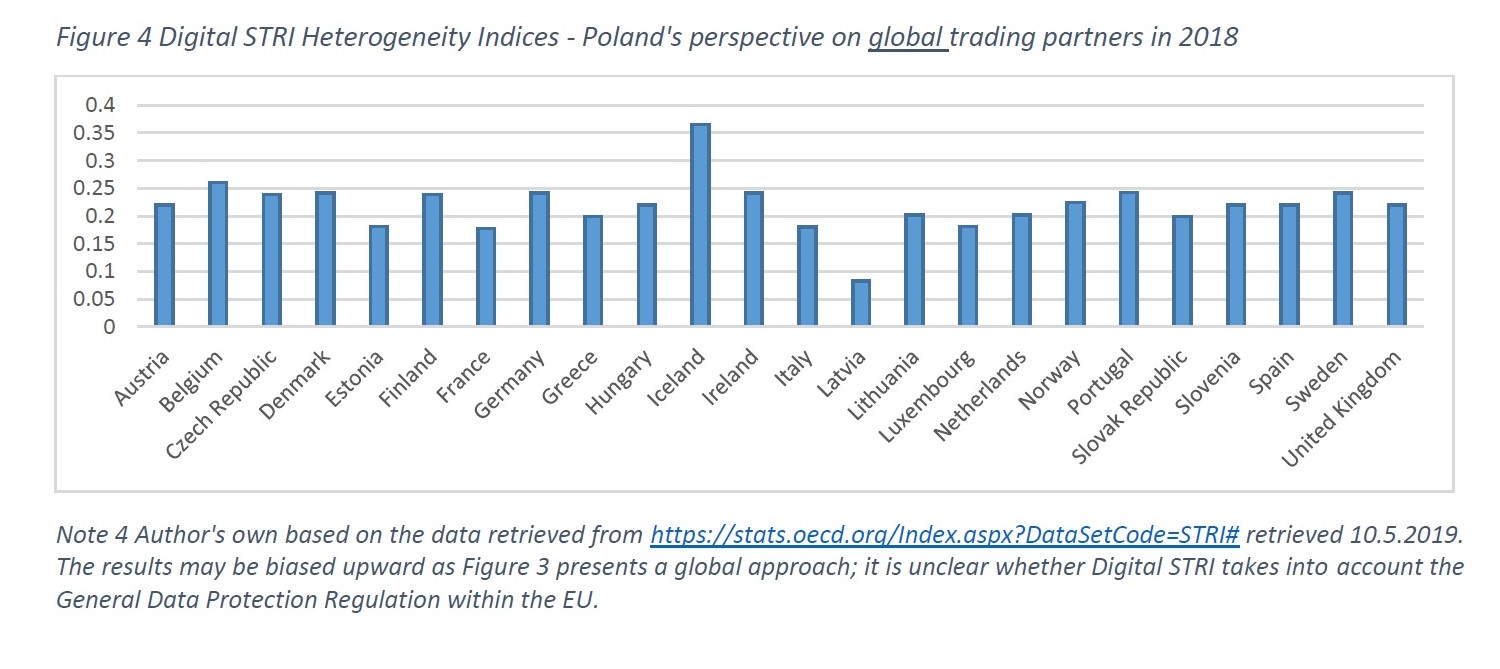

The diversity of nationally adopted regulatory frameworks (as exemplified by Poland and its partners) likely mirrors legal fragmentation of the global environment and creates prohibitive compliance costs for businesses. Yet, businesses, without institutional help are unlikely to surmount the issues of poor connectivity and Internet infrastructure which seem to hinder trade the most. In this area, investment in digitisation and technological development, either funded internationally or by the State, is required if digital services trade is to thrive and be source of profits for SMEs as well as international digital giants.

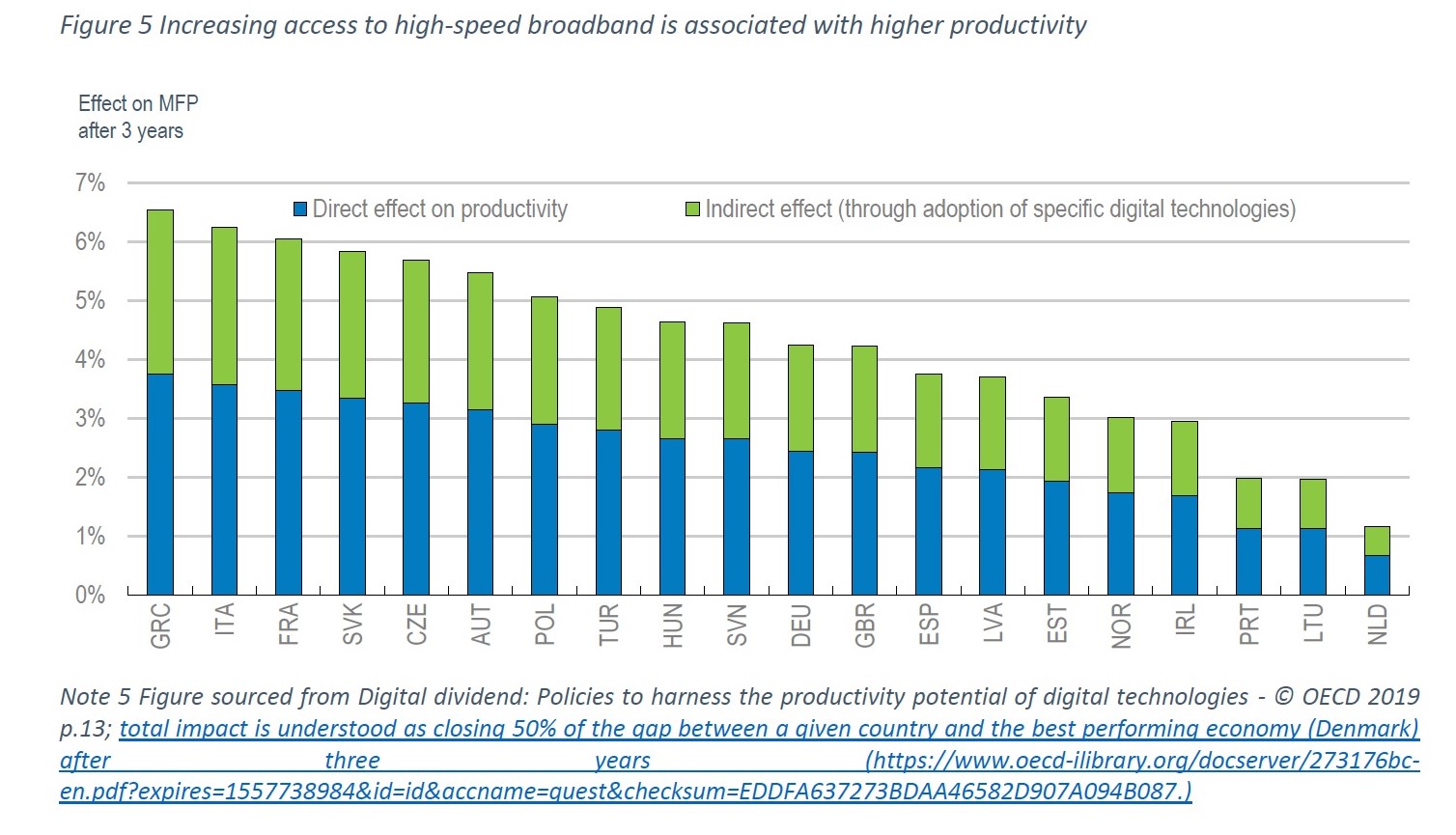

Indeed, it seems that direct and indirect effects of digitisation and infrastructural advancements on business productivity are economically significant. Their impact does not hinge (not entirely, at least) on the initial level of a country’s economic development though: Latvia, Lithuania, or Hungary appear to gain less as measured by the overall efficiency of labour and capital inputs (multi-factor productivity, MFP) than France or Italy (Figure 5).

Food for thought..?

Given the impediments to digital services trade globally and in Europe specifically, it is not surprising that countries stand to gain considerably by removing the existing barriers to trade and preventing overregulation. However, it needs be said that some regulatory solutions are required – they need to be carefully designed to enhance digital economic activities as opposed to quenching them. At the end of the day, it is a question of coming up with regulations which can harness the potential of the digital economy without killing it, flexible and adaptable to national legal systems across the EU.